Congratulations! You are one of the lucky recipients of the Paycheck Protection Program Loan. Not everyone can say the same. Once you receive approval, the bank has ten calendar days to disburse the money. As soon as you receive those funds, the 8-week clock begins to tick. Do not waste time.

For the eight weeks immediately following your loan funding, your expenses must meet certain criteria if you hope to have the loan forgiven. Loan forgiveness is not automatic. You will have to apply for it prior to repayment in six months. Currently, there are no guidelines for the forgiveness application. They will share that information as they develop it.

Using the Loan Proceeds

The entire purpose of the PPP Loan is to maintain payroll. Naturally, using the money for payroll is high on the government’s agenda. Therefore, you must use 75% or more of the money for payroll costs. If payroll costs in the eight-week period do not exceed 75% of the loan proceeds, the amount of loan forgiven will be reduced by the shortage. Payroll costs include:

- Salary, wages, commission, and similar compensation

- For Partnerships – Guaranteed Payments to Partners AND partner’s share of income subject to self-employment tax

- Vacation, sick, family leave

- Severance pay

- Group health insurance premiums

- Company portion of retirement benefits

- State and local tax assessed on employee compensation, such as unemployment, SDI, etc.

WARNING: You may think, well, if I cannot make the 75% in regular payroll, I’ll just bonus myself the difference. Be very careful about unusually high bonuses or commissions to trick the system. You will need documentation. I anticipate random audits and reviews of PPP loan proceeds over the next two years. Free money from the government is a prime opportunity for rampant fraud. Additionally, your employee count must not dip below 25% of your January 31, 2020 employee count.

Not more than 25% of the loan forgiveness may be attributable to non-payroll costs, such as rent, utilities, and mortgage interest. All expenses made in the eight-week period must be for “costs incurred and payments made” within that eight-week period. While this hasn’t been clearly defined, we can assume that you cannot pay your rent six months in advance with the money, nor pre-pay your utilities.

TIP: If you have rent, mortgage, or utilities on autopay, take them off now. Be sure to pay the bills inside the eight-week period for periods included in that eight-week period.

Documentation

If you do not keep accurate time records of your employees’ work, now is a great time to start. You will need proof of commissions, bonuses, pay raises, and vacation/sick time. You will also need to prove that any time off does not overlap with the payroll tax credits of the Families First Coronavirus Response Act (FFCRA). Have all time accurately recorded. Salaried employees do not need to keep time unless they are taking paid time off. Those hours should be clearly documented as to the purpose and length of leave. The FFCRA has more detailed documentation requirements for the employment credits.

Keep and store copies of your rent and utility bills. Utilities include gas, water, electric. Utilities do not currently include internet or cloud hosting at this time. You are required to maintain these records for four years.

Update Your Accounting System

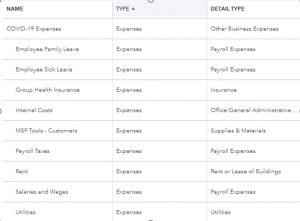

Create a separate account in your accounting system for COVID-19 Expenses and create a list of sub-accounts. Here is a picture of mine:

Be very careful over the eight-week period to carefully post information into the correct category. You want to be able to easily run reports to track your expenses for forgiveness. A quick rundown of the sub-accounts above.

- Employee Family Leave and Employee Sick Leave were created to track FFCRA time off for employment credits. You must keep this separate from other payroll records.

- Group Health and Salaries are to track payroll in the eight weeks separate from payroll in the other parts of the year.

- Rent and Utilities for tracking those expenses during your eight weeks and separating it from other regular expenses

- Optional items for your use only are Internal Costs and MSP Tools for Customers. You will not use these for loan forgiveness, but items purchased specifically for the pandemic can be tracked here to not interfere with other metrics in future/past years for comparison purposes.

Forgiveness – What to Expect

There is another really great reason to separate these expenses. The portion of the loan that is forgiven is technically income to you. The federal government has stipulated this will not be taxable for federal tax purposes. Sounds great, right? Of course! However, there are other considerations.

Be aware that not all states follow the Internal Revenue Code and unless your state specifically excludes the loan forgiveness, you may find yourself paying state income taxes on it.

Also note that it is entirely possible that the expenses that allow the forgiveness of the loan may not be deductible on your tax return, thereby making the loan a complete wash. You (or your tax preparer) will want a nice easy way to find the expenses that are not deductible. Using my method above will go a long way to identify the non-deductible expenses.

It is not clearly stated at this point if those expenses will be non-deductible. At the same time, it is not clearly stated that they will be. We can expect future guidance from the Internal Revenue Service on this. Until then, play it safe and segregate your costs as much as possible. It’s better to be over prepared and not need it, than need it and not be prepared at all.

Stay safe out there!